by Lance Anderson

Homeowners insurance pricing will continue to trend upward in 2025, caused by two primary factors: inflation and global warming. Storms and wildfires have increased to levels we have never seen before, and as long as our planet stays warmer, the storms will continue. Let’s take a look at these two driving trends.

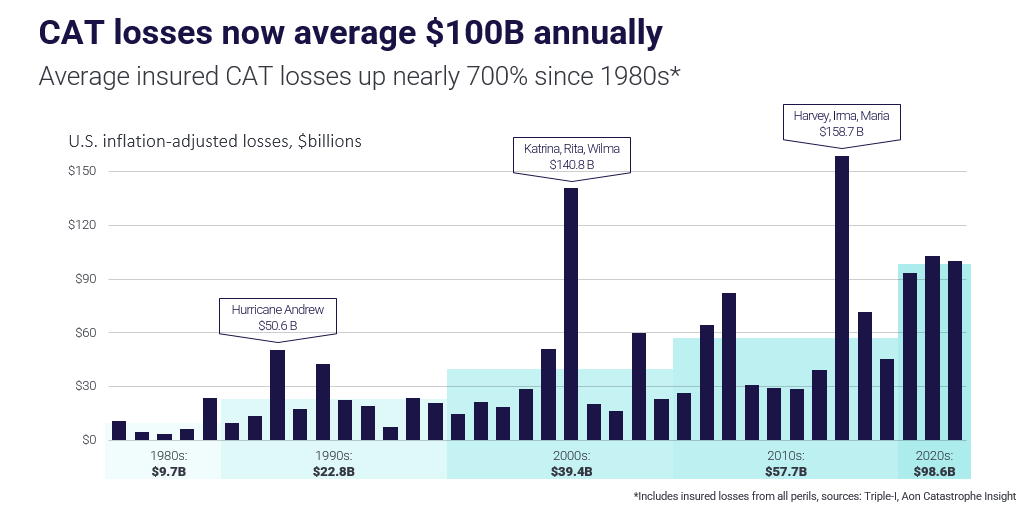

First, higher storm and wildfire activity. CAT or catastrophic insurance losses are a good indicator of what homeowners insurance will cost. The graph below shows that since 2020, the insurance industry in the US has not “caught a break” from catastrophic events. This graph does not consider the LA fires, which will start 2025 off with about 12 billion in losses, most likely pushing the industry to over 100 billion in CAT losses again in 2025 and will undoubtedly be the worst year for wildfire claims.

In addition to hurricanes, we have many more severe convective storms, a term now used more often to describe some of the most common and damaging storms in the US. You might say we don’t see as many storms here in Utah, but as a large insurance agency that receives many claims and reports, we are starting to see much more. On August 10th, 2024, I was attending a wedding in Orem, and when I left the building and started driving home, I called my wife, a little puzzled, and commented that there was snow on the side of the road. Upon arriving home, some neighbors were gathered around a truck in their driveway that had severe hail damage from the storm that had just occurred. In the following days and months, we received more hail storm claims than we ever have before from Utah County, which typically has very mild weather patterns. The August Orem Utah hail storm will be the most costly in Utah County history, but these days it feels very routine until we receive our homeowner’s insurance bill. I have lived in Utah my whole life and have never seen UDOT have to take the snow plows out of storage in the middle of August to clear hail from I-15.

Severe Convective Storms are defined as a local storm, invariably produced by a cumulonimbus cloud and accompanied by lightning and thunder, usually with strong gusts of wind, heavy rain, and hail.

Wildfires in Utah have become an increasing concern caused by a warmer planet. While Utah has not been affected yet, a catastrophic wildfire is undoubtedly in our future. Insurance companies are aware of the risk and see the effects in other areas of the West. Homes near wildfire areas are also exposed to extensive smoke damage as the HVAC systems circulate the smoke from near brush fires into their homes. The cost to mitigate smoke damage can be in excess of $50,000.

Is your home in a high wildfire area? You may be surprised to know where all the areas are. Here’s a link to the Utah Department of Natural Resources assessment portal, where you can input your home address:

Utah Wildfire Risk Assessment Portal

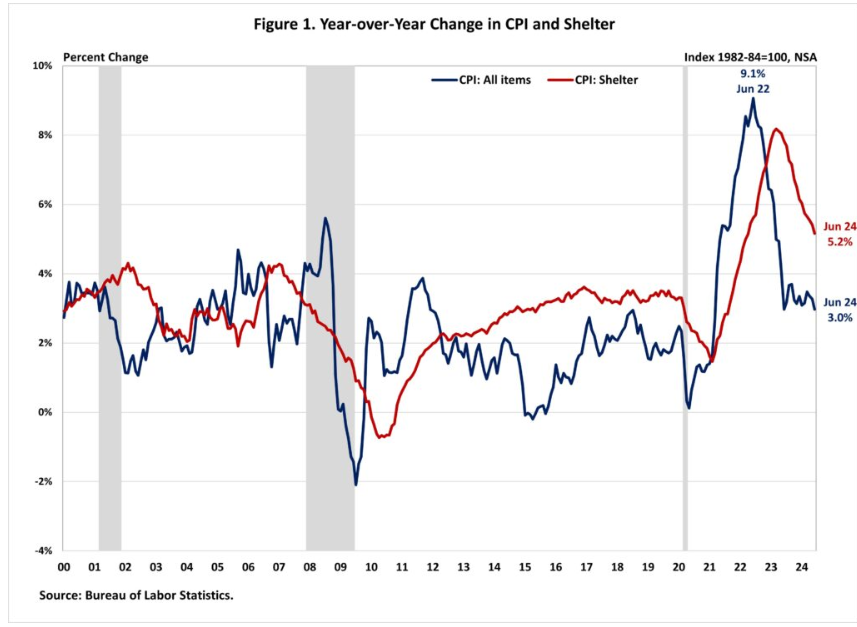

Inflation has been one of the reasons more insurance companies have failed over the last three years than at any other time in history. Insurance companies are large organizations, and due to regulations and market pressures, they cannot react to inflation like perhaps a grocery store can. The insurance industry is still responding to record-high inflation from 2022 that has seeped into 2023 and 2024.

The National Association of Home Builders Eye on Housing graph indicates just how drastic inflation has been causing a big increase in building materials and labor. While current inflation trends are favorable, the insurance industry has some catching up to do so that pricing matches the current level of costs. Inflation Eases Further in June

The good news is that if we can get through the property insurance increases in 2025. Hopefully, the weather will ease, inflation will slow, and insurance costs will stabilize. Insurance is a reflection of what is happening around us, and when we get the bill, it’s a statement of just how much things have changed in three years.

For ideas on saving money on your homeowner’s insurance premium, contact Anderson Insurance Group today. We will review your coverage and recommend any changes, and as independent insurance agents, we have access to many different markets and can look for the best source for your homeowners insurance coverage.

What To Expect From The Homeowners Insurance Inspection | Anderson Insurance Group

Homeowners & Condo Insurance | Anderson Insurance Group

States Where Home Insurance Costs Are Surging Highest

Anderson Insurance Group – Salt Lake City – Utah