“The details of the coverage matter!”

Dwelling: What’s most important is that you carry sufficient dwelling coverage. If you don’t, and you have a loss, the insurance company will pay you a percent of the coverage you should have carried. For example, you carry $200,000 in dwelling coverage and should have carried $400,000 and have a loss for $100,000. The insurance company will hand you a check for $50,000 since you carried 50% of the coverage you should have.

Click here for more information on how you can be penalized for not carrying enough coverage: How does coinsurance work in a commercial property insurance policy? | Anderson Insurance Group

Ordinance & Law: Pays to bring the undamaged portion of a property to code in case of a covered loss. The older the property, the more critical it is to have O & L.

Loss of Rental Income: Some rental properties will take 18 months to rebuild, and some are high-grossing properties. It's important to know how much coverage you have for loss of rent.

Liability: There are two important factors when discussing liability coverage: 1) It only costs an additional $20.00 per year to increase your coverage from the base of $100,000 to $300,000 or even $500,000. And 2) It's essential that you require your tenants to carry renters insurance. Click here for more information: Are You Requiring Renters Insurance? | Anderson Insurance Group

Special Form Coverage: Is the broadest dwelling coverage available almost all rental properties in Utah will be eligible for Special Form coverage, also referred to as a DP-3 form. Don’t settle for less than DP-3/Special Form unless you have to because of the age, location, type or claims history of the property.

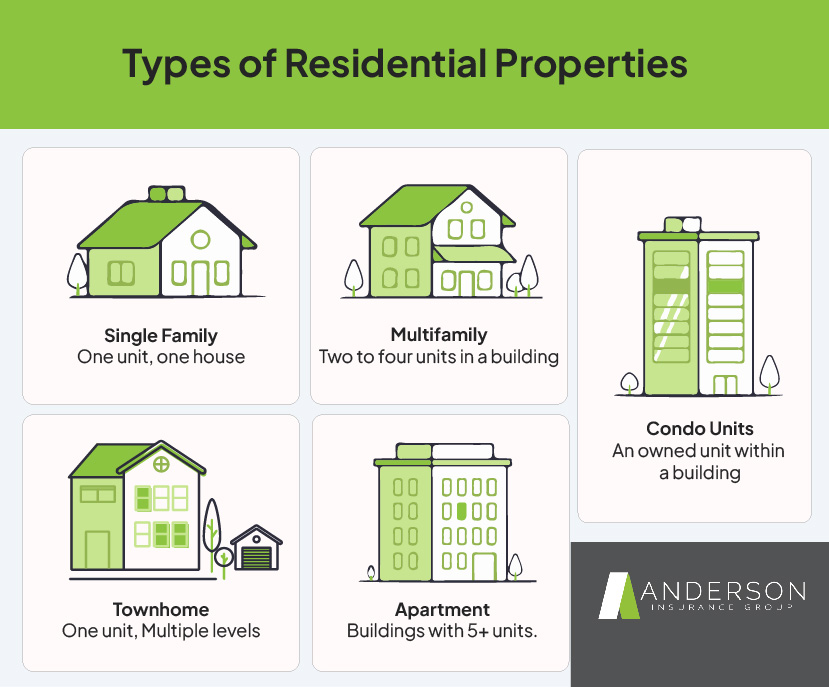

Five Types of Landlord Risks

Single Family Rental Homes

Multi-family homes (duplexes – fourplexes)

Rental Condos

Rental Townhomes

Apartment Buildings Essential Insurance Coverage for Apartment Buildings in Salt Lake City, UT

Five things you can do to better protect yourself as a landlord:

Additional coverage you can add to give yourself the best protection:

Service Line Insurance: covers repairs or replacements of main water and sewer lines, preventing you from facing unexpected out-of-pocket expenses. Service Line Coverage - The Hottest Topic Between Plumbers & Utah Insurance Agents | Anderson Insurance Group This coverage is not offered on every policy. If not available on your policy, you can purchase the coverage through Dominion Energy’s HomeServe program: Dominion Energy | HomeServe

Personal Injury – Will protect you against accusations of discrimination or wrongful evictions and is very inexpensive.

Contents Coverage – Coverage for your appliances and any other removable items you keep on the property.

Loss Assessments – May be necessary if your rental property is part of a homeowners association.

Request a quote and protect your Property today!

Three promises if you buy landlords insurance from an online company:

You will be underinsured.

Many online insurance policies allow landlords to choose their coverage limits without proper guidance. As a result, you may unknowingly select an amount that leaves you underinsured and vulnerable in the event of a claim.

Missing coverage.

Online insurance providers may reduce or exclude essential coverages to keep premiums low. This can leave landlords without crucial protection, leading to financial loss when claims arise.

You will overpay.

That’s correct; the prices from these online-only companies are not competitive. And, if you do pay cheaper now, you will pay when you have a claim. Insurance is like anything, you will either pay now or pay later, either way, cutting corners with insurance coverage does not save that much and is never a good idea.

Trust Anderson Insurance Group

Don’t leave your home at risk with incomplete coverage. Contact us today for a personalized, no-obligation quote.