Buying a new car is an exciting experience, but it’s important to understand the insurance implications to ensure you’re fully protected from the moment you drive your new vehicle off the lot. In Utah, automatic coverage, or the temporary grace period extended by your insurance company, can provide temporary protection while you update your insurance policy. The automatic coverage is typically found under the Other Automobiles Covered or Newly Acquired Auto section of your policy and can be slightly different for each company; refer to your policy for specific details.

How can we help you? in Taylorsville, UT | Anderson Insurance Group

How Does Newly Acquired Auto Coverage Work in Utah?

- Coverage Duration: In Utah, automatic or newly acquired auto coverage typically lasts about 7 – 14 days from the date of purchase, and on some policies up to 30. During this period, your new car is covered under the same coverage as your existing vehicle under the condition that you contact your insurance company before the end of the 7 – 30 day grace period.

- Notification Requirement: The coverage applies only if you notify your insurance company within the specified timeframe. Failing to do so may result in a lapse of coverage, leaving your new vehicle uninsured.

- Types of Coverage: The automatic coverage will mirror the coverage on your existing vehicle. For example, if you have collision and comprehensive coverage on your old car, these will extend to your new car. If you currently have just liability coverage on your car, you will not have full coverage for your additional or replacement car until you contact your insurance company and request it.

Steps to switch insurance to a new car:

- Contact Your Insurance Provider: Your insurance company will need your 1) VIN – vehicle identification number 2) Year make and model and 3) Bank or lien/lease holder information for the car, if any.

- Review and Update Your Policy: Use this opportunity to review your current coverage. New cars often have higher values and different insurance needs. Consider adjusting your coverage limits or adding new types of coverage to better protect your investment. Additional coverages can include, OEM – original equipment manufacturer parts, DV – diminished value coverage or GAP insurance. What is Gap Insurance? | Anderson Insurance Group

- Understand Your Options: Ask your insurance provider about additional coverage options that might be beneficial for your new vehicle.

It is important to note that the automatic coverage for an additional or replacement car only applies to the named insured on the policy, not a child or listed driver purchasing a car registered in their name only. Also be aware that “full coverage”, collision and comprehensive, will not extend to an additional or replacement auto if you do not have full coverage on at least one of the vehicles currently insured on your policy.

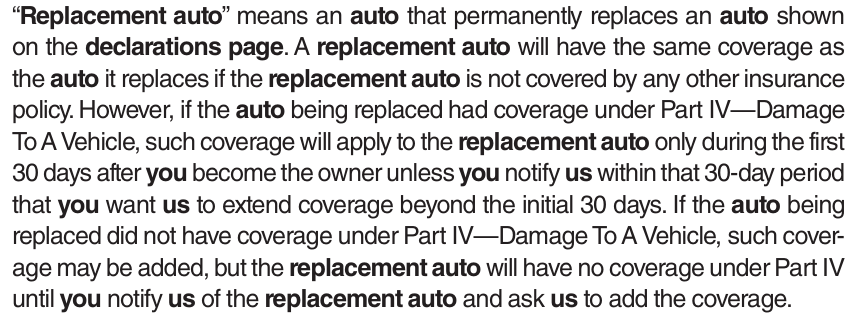

The Progressive Insurance policy language below is some of the broadest with a grace period to add a new car of 30 days. Your policy may only allow 7 or 14 days, refer to your own policy for coverage that will apply to your specific situation.

To provide us information on your new car, please click on the link for the Anderson Insurance Group Customer Care Center:

How can we help you? in Taylorsville, UT | Anderson Insurance Group