Earthquake Insurance Costs/Deductibles/Damage Zones

The experts have been telling us for a long time that we are due for “the big one” – The earthquake that will rattle the Wasatch Front causing significant damage. Purchasing earthquake is an individual decision, Anderson Insurance Group nor its agents are damage zone or earthquake experts. We do however like to provide information so that you can make an educated and informed decision about earthquake insurance.

There are three major factors to take into consideration when purchasing earthquake insurance in Utah. The cost, the deductibles and the damage zone you live in, let’s take a look at these.

The Cost: Earthquake insurance in most cases will double the cost of your homeowners insurance. The average homeowner’s insurance premium in Utah is $1650.00 so the average cost with earthquake insurance will be about double that. There are however many homes in Utah where the cost is much greater and homes where it’s very cost prohibitive to buy earthquake insurance. If your home is solid brick (many Utah homes built before 1960) and even if you could find earthquake insurance the cost will be astronomical. Frame homes don’t have the same limitations but the older the frame home, the more difficult it is to get earthquake insurance.

Deductibles: Earthquake insurance deductibles can range from 5% to 25% depending on the company. Many agents don’t disclose or understand these deductibles are applied three times. First to the dwelling, then to the contents and also to additional living expense. Let’s look at a formula based on a 10% deductible: If Dwelling coverage is $750,000 and contents coverage is $375,000, additional living expense will be $150,000. In this example your dwelling deductible would be $75,000, contents $37,500, and $15,000 for additional living expense for a total out of pocket expense of $127,500. Even if your contents are not damaged earthquake out of pocket costs can easily exceed $100,000. The insurance company is not going to immediately authorize a stay at the Holiday Inn, its a lot more complicated than that.

Damage Zones: There are two primary causes of damage in the event of an earthquake, ground shaking and liquefaction.

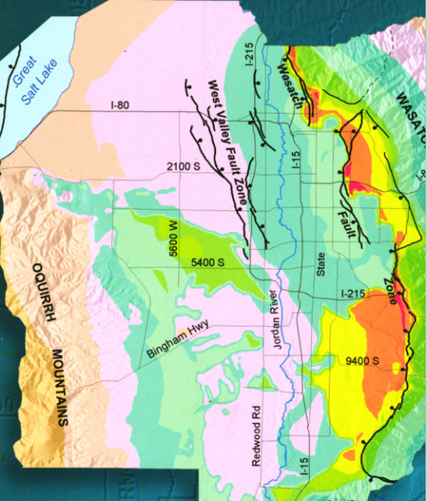

Ground shaking is the shift in the fault that will cause the big jolt in an earthquake. The closer you are to the fault line, the greater the damage. Here are some links to the ground shaking maps in Utah:

The Great Utah ShakeOut – Earthquake Scenarios Links to many Utah segments

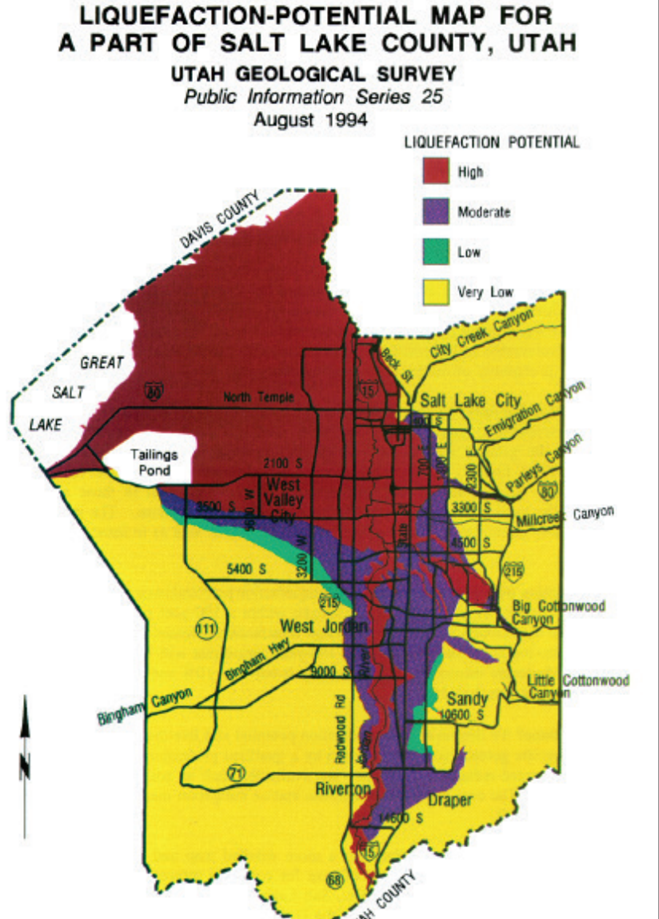

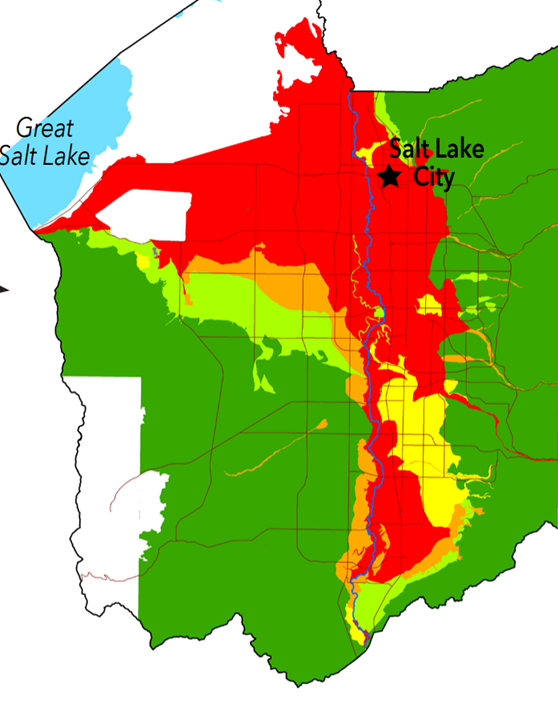

Liquefaction occurs when loosely packed soil liquefies as a result of ground shaking. Most of the damage from liquefaction occurs miles from the fault line and in areas of Utah and the Salt Lake Valley where the Great Salt Lake used to reach. Liquefaction areas are often the lowest points of the valley, here are a few links:

EERI_Scenario_-_FINAL_VERSION_July_16_2015.pdf

The location of the fault lines can also help you make an informed earthquake insurance decision, here’s a link to the fault lines in Utah:

The Wasatch Fault from Above – Utah Geological Survey

Ground Shaking Map for Salt Lake County

Liquefaction Maps for Salt Lake County

For more information about the cost and availability of earthquake insurance for your property reach out to an Anderson Insurance Group agent today.

Anderson Insurance Group – Salt Lake City Utah – 80-1-262-1551